When you pick up a generic prescription, you expect it to be cheaper than the brand-name version. And for the most part, it is. But what you don’t see are the quiet, dramatic shifts happening behind the scenes - the price spikes that turn a $5 pill into a $50 one, or the sudden drops that make it nearly free. Generic drug prices don’t move in a straight line. They jump, crash, and sometimes vanish from shelves altogether. Here’s what actually happened to generic drug prices year by year, and why some of your meds cost more today than they did five years ago.

How Generic Drugs Are Supposed to Work

Generic drugs are exact copies of brand-name drugs. Same active ingredient. Same dose. Same way your body uses it. The only difference? No patent. That means any company can make it - and they do. When the first generic hits the market, the price usually drops 30-40%. Add a second manufacturer? Another 20-30% off. By the time you have four or more companies making the same drug, prices often fall to just 15% of the original brand price.

This isn’t theory. It’s data. In 2018, the FDA found that when five manufacturers were making a generic drug, average prices dropped 65% compared to the brand. That’s how the system is supposed to keep costs low. More competition = lower prices. Simple.

The Year-by-Year Pattern: Stability, Then Shock

On the surface, generic drug prices look stable. In 2023, the average list price increase across all generics was just 4.9%. That sounds reasonable. But that number hides a dark truth: while most generics stayed steady, a small number went wild.

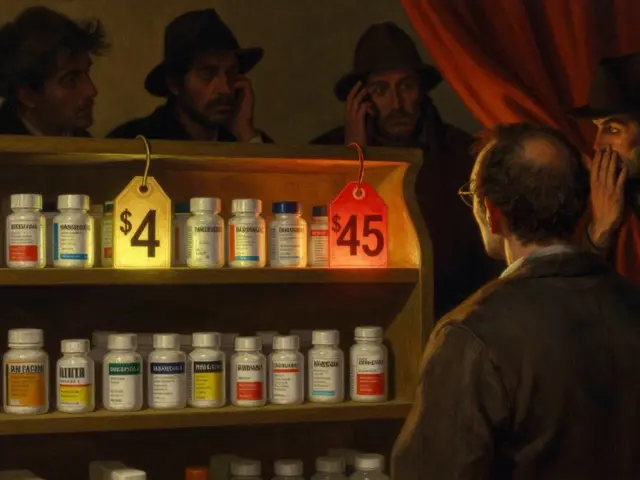

Between January 2022 and January 2023, about 40 generic drugs saw price hikes averaging 39%. One of them? Generic lisinopril. A blood pressure pill that cost $4 at Walmart in 2022 jumped to $45 by the end of 2023 - a 247% increase. That’s not an outlier. It’s a pattern.

Look back further. From 2013 to 2018, the price of generic nitrofurantoin macrocrystals - an antibiotic - went up 1,272%. Meanwhile, generic levothyroxine, used for thyroid issues, dropped 87% over the same period. So why the extremes? It comes down to how many companies are making the drug.

The Three-Company Rule: When Competition Breaks Down

Here’s the key: generic drugs are cheapest when there are five or more makers. But when only two or three companies produce a drug, things get dangerous.

Research from Harvard and the FTC shows that 78% of price increases over 100% happened in markets with three or fewer manufacturers. In 2019, a single manufacturer shut down production of generic doxycycline. Within months, the price jumped 500%. Another company tried to fill the gap - but couldn’t produce fast enough. For months, hospitals scrambled. Patients went without.

By 2018, just 10 companies controlled 70% of the generic drug market. That’s not competition. That’s a cartel waiting to happen. When one of those big players exits a market - whether because of a quality issue, a factory fire, or just a decision to stop making a low-margin drug - prices don’t just rise. They explode.

Why Some Generics Are Still Cheap - And Others Aren’t

Not all generics behave the same. Cardiovascular drugs like metformin or atorvastatin have 10+ manufacturers. Their prices stay low. But drugs for rare conditions - or older ones with low profit margins - often have only one or two makers.

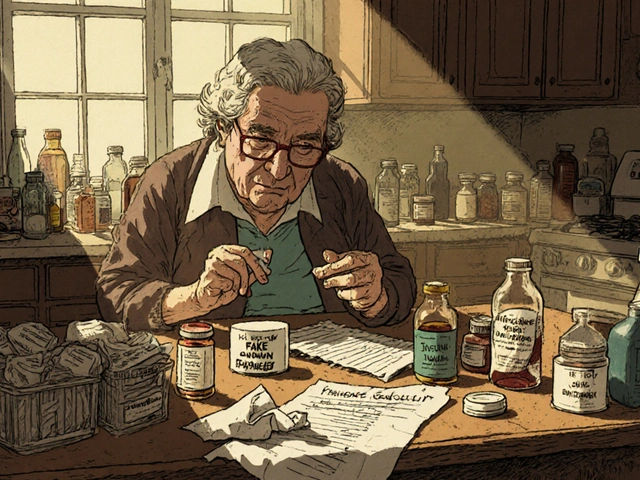

Take generic allopurinol, used for gout. In 2021, only two companies made it. When one of them stopped production, the price jumped 200% overnight. Medicare paid $2.50 per pill. Within a year, it was $7.50. Patients on fixed incomes had to choose between paying for it or their rent.

Meanwhile, insulin - a brand-name drug - got attention. But the generic version of insulin? It’s still expensive because only three manufacturers make it. The FDA approved more generics in 2023, but they won’t hit shelves until 2025. That’s why, even in 2026, some patients still pay $300 for a vial of insulin.

The Hidden Costs: Pharmacies, Patients, and Medicaid

It’s not just patients who get hit. Pharmacies are caught in the middle.

Independent pharmacies buy generics from wholesalers. But wholesalers don’t always know the real cost. They use something called Average Wholesale Price (AWP), which is often 22% higher than what the pharmacy actually pays. When the real price jumps, the pharmacy gets stuck paying more - but can’t raise the price for the patient because of insurance contracts.

In 2023, 42% of independent pharmacies said they lost money on 15% of their generic inventory. Some generics flipped from profitable to loss leaders in weeks. One pharmacy owner told Drug Topics: “We sold 500 prescriptions of a generic antibiotic last year. Made $1,200 profit. This year? Same drug. $800 loss.”

Medicaid patients are especially vulnerable. Before 2024, manufacturers had to offer Medicaid the lowest price they gave to any buyer. But in January 2024, that rule changed. Now, they can charge Medicaid more. The result? A dozen generic drugs saw price hikes in early 2024 - even though they were already cheap.

What’s Changing in 2025 and Beyond

The FDA is trying to fix this. In 2024, they launched a new plan: faster approvals for drugs with only one or two manufacturers. They’re targeting 20% faster reviews for these high-risk drugs. That’s good news - if it works.

But supply chain issues won’t disappear overnight. In 2023, 23% of foreign generic manufacturing facilities failed FDA inspections. That means drugs stop coming. And when they stop, prices spike. The average shortage lasted 6.2 months. For patients on daily meds, that’s months of uncertainty.

The Inflation Reduction Act didn’t directly control generic prices, but it changed the game. Brand-name drugmakers now have to pay rebates if they raise prices faster than inflation. That’s why brand drug prices rose only 2.3% in 2024 - down from 5% before. But generics? No such rule. So manufacturers can still hike prices as long as there’s no competition.

What You Can Do Right Now

If you take a generic drug, here’s what to watch:

- Check your prescription cost every 6 months. If it jumped more than 10%, ask your pharmacist why.

- Use GoodRx or SingleCare. They often show prices 50-80% lower than pharmacy cash prices.

- Ask if your doctor can switch you to a similar drug with more competition. For example, switching from one generic statin to another might cut your cost in half.

- If you’re on Medicare, look at your Part D plan’s formulary. Some plans exclude high-cost generics.

And if you’re paying more than $20 a month for a generic that’s been on the market for 10+ years - you’re probably overpaying. That’s not normal. That’s a red flag.

Why This Matters

Generic drugs saved the U.S. healthcare system over $2.2 trillion between 2008 and 2017. That’s money that went to hospitals, not drugmakers. But now, the system is cracking. The 10% of generic drugs with the worst price spikes account for 60% of all generic spending growth.

This isn’t about greed. It’s about broken incentives. When only a few companies make a drug, they don’t compete on price - they compete on who can survive the next shortage. And patients pay the price.

For now, the system still works for most people. But for too many, a simple prescription has become a gamble.

Why do generic drug prices go up even when there are multiple manufacturers?

Even with multiple manufacturers, prices can rise if one or more companies stop making the drug. This often happens when manufacturing becomes unprofitable due to low margins or regulatory issues. When supply drops, the remaining makers raise prices - sometimes dramatically. A market with three manufacturers isn’t truly competitive if one of them exits suddenly.

Are generic drugs always cheaper than brand-name drugs?

Generally, yes - but not always. Some generics, especially those with limited competition, can cost more than their brand-name versions due to supply shortages or price gouging. For example, in 2023, a generic version of a heart medication cost more than the brand because only one company was making it. Always compare prices using tools like GoodRx.

How does the FDA help control generic drug prices?

The FDA doesn’t set prices, but it influences them by approving more manufacturers. Faster approvals mean more competition, which drives prices down. In 2023, the FDA approved 843 generic drugs - the highest number in history. They’re now prioritizing approvals for drugs with fewer than three manufacturers to prevent price spikes.

Can I switch to a different generic version of my drug to save money?

Yes - if your doctor approves it. Many generic drugs have multiple manufacturers, and prices can vary significantly between them. For example, one version of metformin might cost $3, while another costs $25. Ask your pharmacist to check which version your insurance covers and which is cheapest at your local pharmacy.

Why do generic drug prices vary so much between pharmacies?

Pharmacies pay different prices based on their suppliers, contracts, and how they’re reimbursed. Independent pharmacies often pay more than big chains, and insurance reimbursement rates don’t always match real costs. That’s why a drug might cost $12 at CVS but $3 at Walmart - and why using discount cards like GoodRx can save you hundreds.

What’s the difference between Average Wholesale Price (AWP) and Actual Acquisition Cost (AAC)?

AWP is a list price set by wholesalers - often inflated - and used by insurers to calculate reimbursements. AAC is what the pharmacy actually paid for the drug. The gap can be 20% or more. When AAC rises but AWP doesn’t, pharmacies lose money. This is why some pharmacies stop carrying certain generics - they can’t afford to sell them.

Generic drugs were meant to make medicine affordable. But without real competition, they’ve become another source of uncertainty. The system still works - for now. But if nothing changes, the next price spike won’t be an anomaly. It’ll be the new normal.

Joanne Tan

I just got my lisinopril bill this month and nearly passed out. $45?! I swear, my pharmacist looked at me like I was crazy for asking why. I’ve been on this for 8 years. This isn’t healthcare, it’s a rigged game. 🤦♀️

Reggie McIntyre

This whole system is wild. One minute you’re paying $5, next thing you know you’re paying $50 for the same little pill. It’s like the pharmaceutical world is playing monopoly and we’re all just pawns. But hey, at least we’ve got GoodRx to save our sanity. 🙌

Carla McKinney

The FDA’s ‘faster approvals’ are a band-aid on a hemorrhage. They approved 843 generics last year? Great. But 23% of foreign facilities failed inspections. That’s not progress - that’s a ticking time bomb. And Medicaid’s new rule? Pure betrayal. You don’t get to raise prices on the most vulnerable and call it ‘market dynamics.’ It’s exploitation dressed in regulatory jargon.

Stacie Willhite

I just want to say - if you’re paying over $20/month for a 10+ year old generic, you’re not alone. I switched my metformin from one brand to another and cut my cost in half. It took three calls to my pharmacy and one email to my doctor, but it worked. You can do this. Don’t give up. Small changes add up.

Jason Pascoe

Interesting stuff. Down under, we’ve got the PBS system - it’s not perfect, but at least there’s a cap. Here in the US, it feels like the market’s been handed over to a handful of guys in suits who think ‘low margin’ means ‘no margin at all.’ Maybe we need a public option for generics. Just a thought.

Rob Turner

I remember when I used to get my dad’s generic levothyroxine for $3 at Boots. Now? $22. And he’s on a fixed income. It’s not just about greed - it’s about how we’ve stopped seeing medicine as a human right. More factories ≠ more humanity. We need to rebuild the moral architecture of this system. 🕊️

Rachidi Toupé GAGNON

GoodRx saved my life last year. Paid $1.99 for a 30-day supply of doxycycline. Pharmacist said, ‘I’ve never seen this price before.’ Turns out, the manufacturer had a hiccup - and someone else stepped in. That’s the chaos. That’s also the hope.

Vamsi Krishna

You people are so naive. This isn’t about competition - it’s about control. The same 5 corporations own 80% of the generic market through shell companies. The FDA? They’re just the PR arm. And Medicaid? They’re the suckers who pay for the whole charade. Wake up. This is systemic. Not accidental. And it’s been this way for decades. You just didn’t notice until it hit your wallet.

Brad Ralph

So… we’re saying the solution is to… wait longer for more generics? Meanwhile, grandma’s skipping her pills to afford groceries. 🤡

christian jon

THIS IS A NATIONAL EMERGENCY!! WHY ISN’T THE MEDIA OUTRAGED?! PEOPLE ARE DYING BECAUSE THEY CAN’T AFFORD A $5 PILLS THAT NOW COST $50!! WHO’S IN CHARGE OF THIS?!! THE FDA? THE GOVERNMENT? THE PHARMACEUTICAL INDUSTRY?! THEY’RE ALL IN ON IT!! WE NEED A REVOLUTION!! #PRICEGOUGING #GENERICCRISIS #JUSTICEFORPATIENTS

Joanne Tan

@Reggie McIntyre - you said GoodRx saved your sanity? I just used it to find a $2.50 version of my allopurinol. I cried. Not because it was cheap - because I’d been paying $12 for years and never thought to ask. Thank you for reminding me I’m not powerless.