By the end of 2025, millions of Americans will face a hard choice: pay significantly more for health insurance or go without coverage. The enhanced subsidies that have kept ACA plans affordable since 2021 are set to expire on December 31. For many, that means premiums could jump by more than 100%. If you’re enrolled in a Marketplace plan, understanding what you’re getting - and what’s about to change - isn’t just helpful. It’s essential.

What ACA Plans Actually Cover

ACA plans don’t just offer basic coverage. They’re required to include ten essential health benefits, no matter which insurer you pick or which state you live in. That means every Bronze, Silver, Gold, or Platinum plan must cover:- Ambulatory patient services (doctor visits)

- Emergency care

- Hospitalization

- Pregnancy, maternity, and newborn care

- Mental health and substance use disorder services

- Prescription drugs

- Rehabilitative and habilitative services

- Laboratory services

- Preventive and wellness services

- Pediatric services, including dental and vision care for kids

These aren’t optional add-ons. They’re the law. Even the cheapest Bronze plan has to include them. That’s a big deal compared to pre-ACA plans, where insurers could exclude maternity care, mental health, or prescription drugs outright.

And here’s something else that changed: insurers can’t deny you coverage or charge you more because of a pre-existing condition. That includes diabetes, cancer, asthma, even depression. Before the ACA, people with chronic illnesses were often priced out or turned away. Now, that’s illegal.

How Metal Tiers Work - And What They Really Mean

ACA plans are grouped into four metal tiers: Bronze, Silver, Gold, Platinum. These aren’t marketing labels. They’re actuarial values - meaning they tell you what percentage of your medical costs the plan will pay on average.- Bronze: Covers 60% of costs. You pay 40%. Lowest monthly premium, highest out-of-pocket costs.

- Silver: Covers 70%. You pay 30%. This is the most popular tier because it’s the only one that qualifies for cost-sharing reductions (CSRs) if your income is below 250% of the poverty level.

- Gold: Covers 80%. You pay 20%. Higher premiums, lower bills when you need care.

- Platinum: Covers 90%. You pay 10%. Highest premiums, lowest out-of-pocket costs.

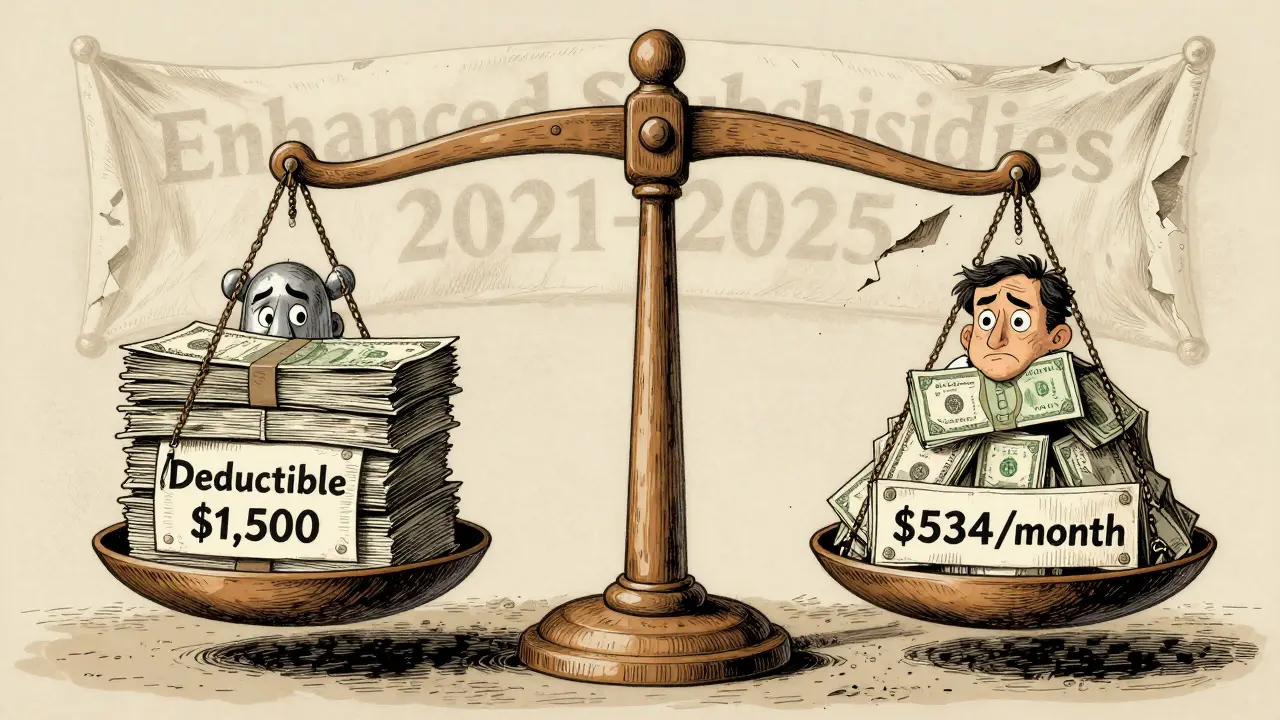

Most people don’t realize that Silver plans can be way cheaper than they look. If your income is between 100% and 250% of the Federal Poverty Level (FPL), you get extra help lowering your deductibles and copays. That’s called a Cost-Sharing Reduction. For example, a Silver plan might have a $6,000 deductible normally - but with CSR, it drops to $1,500. That’s a game-changer if you have ongoing medical needs.

Who Gets Financial Help - And Why It’s Disappearing

The real magic of the ACA in recent years has been the enhanced premium tax credits. Before 2021, subsidies only kicked in if your income was between 100% and 400% of the FPL. If you made $55,000 in a state where the poverty line was $14,000, you got nothing.The American Rescue Plan changed that. From 2021 through 2025, the cap was removed. Even people making $80,000 or $100,000 could get help if their plan premium was more than 8.5% of their income. That’s why enrollment jumped 20% in 2024 - to 17.3 million people.

But on January 1, 2026, that changes. The subsidy cap returns. If you make more than 400% of the FPL, you get no subsidy. For a single person in most states, that’s about $58,000. A family of four? Around $120,000.

Here’s what that means in dollars: A 40-year-old earning $50,000 currently pays about $247 a month for a Silver plan with subsidies. Without them? $534. That’s $3,450 more a year. For a 60-year-old, the jump can be even worse - up to 192% in some states, according to Kaiser Family Foundation data.

What’s Changing in 2026 - And Who Gets Left Out

The CMS 2025 Final Rule, effective November 11, 2025, brought more than just subsidy changes. It also ended eligibility for DACA recipients. That means roughly 550,000 people who’ve been paying into the system and using care will lose coverage starting in 2026. No exceptions. No grace period.There’s also a new requirement: you’ll have to update your income every quarter starting in 2026. Right now, you report your income once a year. If your income drops mid-year, you can’t adjust your subsidy until tax time. That’s why so many people get hit with big tax bills - they got too much help upfront because their income fell unexpectedly.

One Reddit user, u/ACA_Warrior, shared a story: their income dropped 30% in the middle of the year. They couldn’t adjust their subsidy. By December, they owed $2,800 in medical bills they didn’t expect. That’s not rare. Nearly 60% of negative reviews on Trustpilot mention this issue.

Starting in 2026, quarterly updates should cut those errors by 40%, according to CMS modeling. But it adds complexity. Self-employed people, gig workers, and freelancers will need to track income more closely than ever.

ACA vs. Employer Insurance - The Real Trade-Offs

Many people assume employer-sponsored insurance is always better. Not always. ACA plans often give you more choice in doctors. Employer plans usually have narrow networks. But ACA plans can be more expensive if you don’t qualify for subsidies.The big win for ACA plans? The “family glitch” fix in 2023. Before that, if your employer offered affordable coverage for you but not your spouse or kids, they couldn’t get subsidies. Now they can. That opened up coverage for millions of families.

But ACA plans still have higher out-of-pocket maximums than Medicare Advantage. In 2025, the cap for ACA plans is $9,450 for individuals. Medicare Advantage is capped at $8,300. That difference matters if you need major surgery or long-term treatment.

Who Should Enroll - And Who Shouldn’t

If you’re under 30 and healthy, you might think a catastrophic plan is the way to go. It’s cheaper. But it only covers three primary care visits and preventive care. No prescriptions, no mental health, no maternity. If you get hurt or sick, you’re on your own.If you’re between 100% and 250% of the FPL, Silver plans with cost-sharing reductions are the best value. You get lower deductibles, lower copays, and lower premiums thanks to subsidies.

If you’re over 65, you’re on Medicare. ACA plans aren’t for you. If you’re under 138% of the FPL and live in a Medicaid expansion state, Medicaid is cheaper and more comprehensive than any Marketplace plan.

If you’re above 400% of the FPL and don’t have employer coverage, you’ll pay full price. That’s going to hurt. Premiums are already rising faster than wages. Without subsidies, many will drop coverage.

What You Need to Do Before January 1, 2026

If you’re enrolled in a Marketplace plan:- Check your current subsidy amount. Log into HealthCare.gov and look at your “Financial Assistance” section.

- Estimate your 2026 income. Will it still be under 400% of the FPL? If not, prepare for a big premium increase.

- Review your plan’s network. Make sure your doctors are still in-network. Many insurers change networks every year.

- Consider switching to a Bronze plan if you’re healthy and don’t use care often. Premiums are lower, even without subsidies.

- If you’re self-employed or have variable income, start tracking your monthly earnings now. You’ll need to report them quarterly in 2026.

And if you’re not enrolled yet? Open enrollment for 2026 starts November 1, 2025. Don’t wait. The sooner you lock in a plan, the more time you have to adjust your budget.

What People Are Saying - Real Stories from the Marketplace

Sarah K., a freelance writer in Ohio earning $32,000 a year, says: “I get a $0 premium Silver plan with full cost-sharing reductions. My prescriptions cost $5. My doctor visits are $10. I’d be bankrupt without this.” HealthyInTX on Reddit: “I qualified for $0 premium. Then I had to file three corrected tax returns because the subsidy didn’t match my actual income. The system is broken.”These aren’t outliers. They’re the reality of a system that works well for millions - but is hanging by a thread.

The ACA didn’t fix all of American health care. But it gave millions access to coverage they didn’t have before. The question now isn’t whether the law works. It’s whether we’ll let the subsidies expire - and who pays the price when they do.

Do ACA plans cover pre-existing conditions?

Yes. Under the Affordable Care Act, insurance companies cannot deny coverage or charge higher premiums because of a pre-existing condition like diabetes, cancer, asthma, or depression. This protection applies to all Marketplace plans, regardless of metal tier.

What happens to my subsidy after December 31, 2025?

The enhanced premium tax credits introduced in 2021 expire on December 31, 2025. Starting January 1, 2026, subsidies will only be available if your income is between 100% and 400% of the Federal Poverty Level. If you earn more than that, you’ll pay full price for your plan - which could mean premiums doubling or tripling.

Can I still get help with out-of-pocket costs in 2026?

Yes - but only if you’re on a Silver plan and your income is below 250% of the Federal Poverty Level. These are called Cost-Sharing Reductions. They lower your deductible, copays, and out-of-pocket maximum. If your income rises above 250% FPL, you’ll lose this extra help, even if you still get a premium subsidy.

Are DACA recipients still eligible for ACA plans in 2026?

No. As of November 11, 2025, the CMS Final Rule eliminated eligibility for DACA recipients to enroll in ACA Marketplace plans. Approximately 550,000 people who currently have coverage through the Marketplace will lose it unless Congress passes new legislation.

How do I know if I qualify for a subsidy?

You qualify if your household income is between 100% and 400% of the Federal Poverty Level, and you don’t have access to affordable employer coverage. Use the subsidy calculator on HealthCare.gov. You’ll need your estimated 2026 income, household size, and zip code. Self-employed people should use Modified Adjusted Gross Income (MAGI), not gross revenue.

What if my income changes during the year?

Starting in 2026, you’ll be required to update your income every quarter. If your income drops, you can get more subsidy. If it rises, your subsidy may be reduced. This is meant to reduce tax reconciliation surprises, but it adds administrative work. If you don’t update, you might owe money at tax time.

Are ACA plans better than Medicaid?

If you qualify for Medicaid (income under 138% of FPL in an expansion state), Medicaid is better. It has lower or no premiums, lower out-of-pocket costs, and broader provider networks. ACA plans are designed for people who earn too much for Medicaid but can’t afford private insurance without help.

What Comes Next

The ACA’s future isn’t written yet. Congress could extend the subsidies. It could expand Medicaid in the 10 remaining non-expansion states. It could fix the quarterly reporting burden. But right now, the clock is ticking. Millions of people are just weeks away from losing financial help they’ve come to rely on.If you’re one of them, don’t wait for someone else to fix it. Log into HealthCare.gov. Know your numbers. Know your options. The system isn’t perfect - but for many, it’s the only thing standing between them and medical bankruptcy.

Retha Dungga

life is just a series of insurance forms and surprise bills 🤷♀️💸 we’re all just trying to survive the system, not fix it

Sara Stinnett

Let’s be brutally honest-this isn’t about healthcare. It’s about power. The moment you make healthcare a commodity, you’re not just pricing out the poor-you’re pricing out dignity. And now they’re stripping away the safety net like it’s a bad habit. The real tragedy? We knew this was coming. And we still let it happen.

linda permata sari

I’m from Indonesia and I just cried reading this. In my country, you pay out of pocket or you don’t get care. Here, people are losing subsidies and still thinking it’s ‘too expensive’? We’d kill for a Bronze plan with mental health coverage. This system is broken-but it’s still the best we’ve got. Don’t take it for granted.

Brandon Boyd

You got this. Seriously. Even if your premium doubles, you’re not alone. Millions are in the same boat. Log into HealthCare.gov TODAY. Check your numbers. Talk to a navigator. This isn’t about fear-it’s about action. You’ve survived 2020, 2022, 2024. You’re not quitting now.

Paul Huppert

I’m on a Silver plan with CSR. My deductible dropped from $6k to $1.5k. I didn’t even know that was a thing until last year. Now I’m terrified it’s going away. Anyone know if the CSR eligibility will change with the subsidy cap?

Hanna Spittel

daca recipients get kicked out but billionaires get tax breaks 🤡 #healthcareisacriminalenterprise

Brady K.

Ah yes, the ACA-where the government subsidizes your premiums but then makes you audit your income quarterly like you’re running a hedge fund. Brilliant. Let’s just add a 10-page PDF form titled 'Why Your Freelance Income Went From $4k to $1.2k in Q2' and call it 'progress'. This isn’t healthcare reform-it’s bureaucratic warfare dressed in blue.

Kayla Kliphardt

I’ve been on Medicaid since 2020. I didn’t even know people on Marketplace plans had to worry about this. It’s wild how two systems can exist in the same country and feel like different planets.

Stewart Smith

i’m just here wondering if anyone’s actually gotten a $0 premium plan and didn’t end up owing $3k at tax time. because that’s the vibe i’m getting.

Jenny Salmingo

my mom’s on a Silver plan. She’s 58, diabetic, needs insulin. She pays $12/month. If this goes away, she’ll skip doses. That’s not a choice. That’s a death sentence.

Aaron Bales

If you’re over 400% FPL and don’t have employer insurance, your best move is a High Deductible Health Plan paired with an HSA. You get tax deductions now, and the money grows tax-free. It’s not perfect, but it’s better than nothing.

Lawver Stanton

I’ve been reading this whole thing and I just want to scream. You know what’s worse than the subsidy expiration? The fact that no one in Congress is even talking about it. The media’s silent. The influencers are posting memes about avocado toast. And here we are, 50 days out from losing coverage, and the only thing trending is a cat in a tutu. We’re not just failing people-we’re forgetting them. And that’s the real crime.

Branden Temew

so we’re saying the system that saved my sister’s life after her cancer diagnosis is now a ticking time bomb because rich people don’t like paying taxes? i’m not mad. i’m just… disappointed. like, deeply. in all of us.