Copay Differentials: Why Your Prescription Costs Vary by Pharmacy and Plan

When you pick up a prescription, the price you pay isn’t always the same—even if you have the same insurance plan. This gap is called a copay differential, the difference in out-of-pocket cost for the same medication at different pharmacies under the same insurance plan. Also known as pharmacy pricing variation, it’s not a mistake. It’s built into how drug plans negotiate prices with pharmacies and how those deals get passed (or not passed) to you. You might pay $10 for metformin at one store and $35 at another, even though both are in-network. That’s a copay differential in action.

These differences aren’t random. They’re shaped by three big things: your insurance plan, the specific drug benefit structure and pharmacy network negotiated by your insurer, the pharmacy network tier, how insurers group pharmacies into preferred, standard, or non-preferred tiers based on pricing agreements, and where you live. A pharmacy in a wealthy zip code might charge more because the insurer pays them a higher reimbursement rate. A pharmacy in a rural area might charge less because they’re trying to attract more customers. And some pharmacies—especially mail-order or big-chain stores—get better deals because they buy in bulk and agree to strict terms.

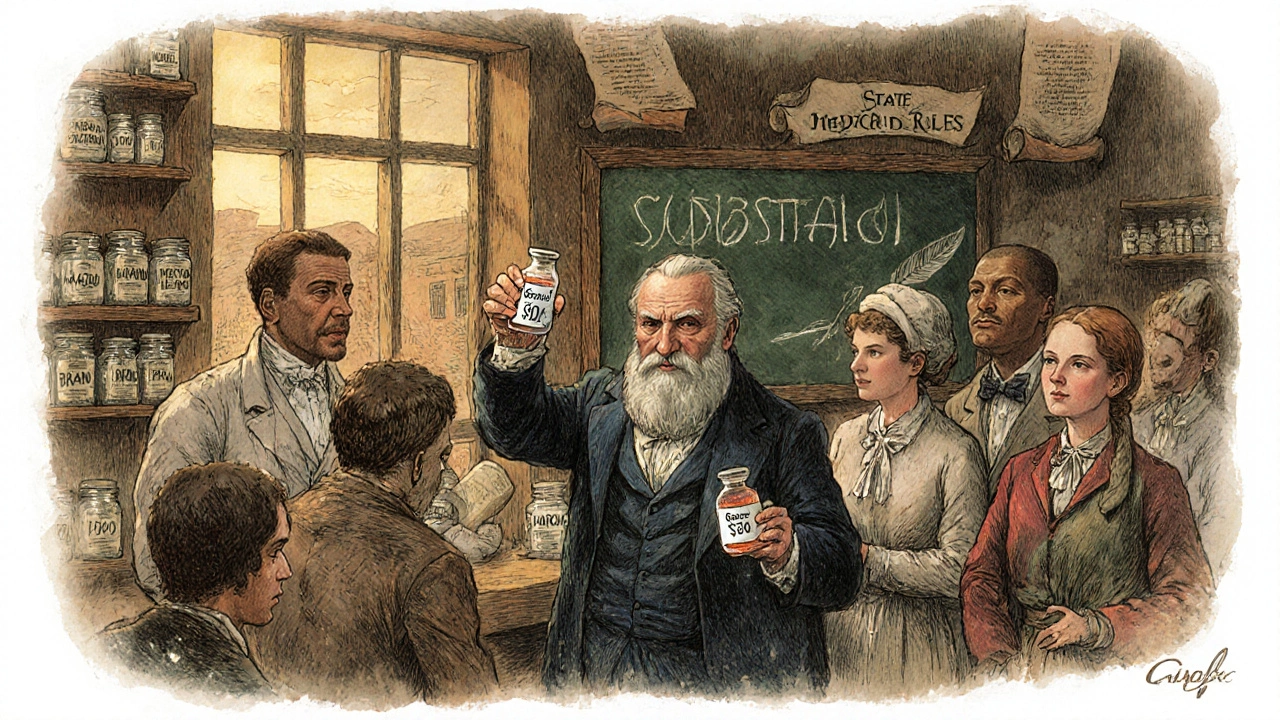

It gets more complicated when you’re on multiple medications. One drug might have a low copay at CVS, but another—say, a specialty drug like Prograf or rosuvastatin—might be cheaper at Walmart or through a Canadian pharmacy like RX Canada 4 Less. That’s because insurers often create separate tiers for brand-name vs. generic drugs, and some pharmacies specialize in certain types of prescriptions. State laws on generic drug substitution, rules that let pharmacists swap brand drugs for cheaper generics when allowed also play a role. If your pharmacist can legally switch your brand drug to a generic, your copay drops. But if they can’t—because of state law or your plan’s restrictions—you’re stuck paying more.

And here’s the thing: most people don’t even know this is happening. They assume their insurance covers the same price everywhere. But copay differentials can add up fast. A $25 difference on one monthly drug? That’s $300 a year. On three drugs? $900. That’s why checking prices before you fill a prescription isn’t just smart—it’s necessary. Some plans offer price comparison tools. Others don’t. That’s where sites like RX Canada 4 Less come in, offering transparent pricing on medications like gabapentin, Motrin, or indapamide without the middleman costs of U.S. pharmacy networks.

You’ll find posts here that dig into real-world examples: how HIV protease inhibitors mess with birth control, why decongestants can trigger urinary retention in men with enlarged prostates, and how state laws force pharmacists to make tough choices. All of these connect back to one thing: your out-of-pocket cost isn’t just about your insurance—it’s about who’s selling the drug, where, and under what rules. The goal isn’t to confuse you. It’s to help you see the hidden system behind your receipt—and find ways to pay less without sacrificing care.

States are using copay differentials, preferred drug lists, and pharmacist substitution rules to push patients toward cheaper generic drugs. These policies save billions-but can also cause shortages if manufacturers pull out due to rebate rules.